san francisco sales tax rate breakdown

Sales tax region name. The name of the officer facilitating the closing.

Berkeley Sales Tax Hike Takes Effect Berkeley Ca Patch

Between 2018 and 2019 the population of San Diego CA declined from 143M to 142M a 0151 decrease and its median household income grew from 79646 to 85507 a 736 increase.

. The County sales tax rate is. A state income tax is collected on a sliding scale depending on your income. San Francisco is a city where tolerance deteriorates into license.

Food and prescription drugs are exempt from sales tax. This tax does not all go to the state though. Californias taxes are some of the highest in the US with a base sales tax rate of 725 and a top marginal income tax rate of 133.

The California sales tax rate is currently. San Francisco CA Sales Tax Rate. Bottom Line Bookkeeping and Tax in Salt Lake City UT offers a 99 tax return with full itemizing a 79 no itemizing return and a 35 student rate for high school and college students.

California has the highest statewide sales tax rate at 725 percent and is ranked ninth by the Tax Foundation in combined state and local sales tax rates. This is the total of state county and city sales tax rates. The General Services Administration for example sets a standard rate for the continental United States but also sets separate rates in cities that have higher meal costs.

The true state sales tax in California is 6. Childcare is an expense that can overtake the price of rent in some budgets. Its 93 percent for those making 53000 to 269000 and 133 percent for those making 1 million or more.

Pimental estimated that in fiscal year 2021-22 general fund balance was reduced by 267 million in comparison to the budget adopted in September 2021. San Francisco residents can expect to pay a minimum combined 85 sales tax rate. Although the Golden State has high taxes it does play host to a number of bustling industries.

Major cities such as New York Chicago Los Angeles and San Francisco stay on the higher end of meal per diem rates. Not to mention the state tax rate is combined with local-level tax rates so you can expect to pay a higher rate depending on your city of residence. This rate is made up of a base rate of 6 plus California adds a mandatory local rate of 125 that goes directly to city and county tax officials.

California Sales Tax. One involved the Scripps Institution of Oceanography in San Diego which used a 560000 grant from the National Science Foundation to force fish to exercise to exhaustion on treadmills as part of a 2009 study. Think of the escrow number like a bank account number its a series of digits specific to a single transaction between a buyer and seller.

In 2019 San Diego CA had a population of 142M people with a median age of 354 and a median household income of 85507. Eckerman Tax Services has tax return prices beginning at 55. We would like to show you a description here but the site wont allow us.

In 2019 for example the group allots 76 for daily meal and incidental costs in. The minimum sales tax in California is 725. Tax rates last updated in February 2022.

The sales tax rate in Texas is relatively low at 625 though it will still affect your budget. ZeroHedge - On a long enough timeline the survival rate for everyone drops to zero. There are five additional tax districts that apply to some areas geographically within San Francisco.

However its a necessary. Depending on local sales tax jurisdictions the total tax rate can be as high as 1025. The sales tax rate can jump in other areas of the county.

They even offer a free tax return for missionaries. The scientists chose mudskippers because of their unique ability to use their fins like legs for extended periods of time when out of the water. First Columbia will receive a 122 million property tax exemption under a 20-year payment-in-lieu-of-taxes PILOT agreement.

The San Francisco sales tax rate is. There are about 25000 injection drug users in San Francisco a number 50 larger than the number of students in the citys 15 public high schools 43. 2 million in exemptions on sales and compensating use taxes.

Heres a line-by-line breakdown. Instead of the rates shown for the San Francisco Tourism Improvement District tax region above the following tax rates apply to. The state then requires an additional sales tax of 125 to pay for county and city funds.

A town without a norm 224. All in all youll pay a sales tax of at least 725 in California. Oklahoma County Government is here to serve the public and is represented by 9 elected officials including the Assessor County Clerk Court Clerk District Attorney 3 County Commissioners - District 1 District 2 and District 3 Sheriff and Treasurer.

The minimum combined 2022 sales tax rate for San Francisco California is. The California state sales tax rate is 725. Date and time of the closing such as June 15 2018 at 10 am.

The current total local sales tax rate in San Francisco CA is 8625The December 2020 total local sales tax rate was 8500. The state has the highest personal income tax rate for its wealthiest. San Francisco Tourism Improvement District.

That is one bracing data point among the many in this book.

How To Prepare For Trump S Middle Class Tax Hike Financial Samurai

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Understanding California S Sales Tax

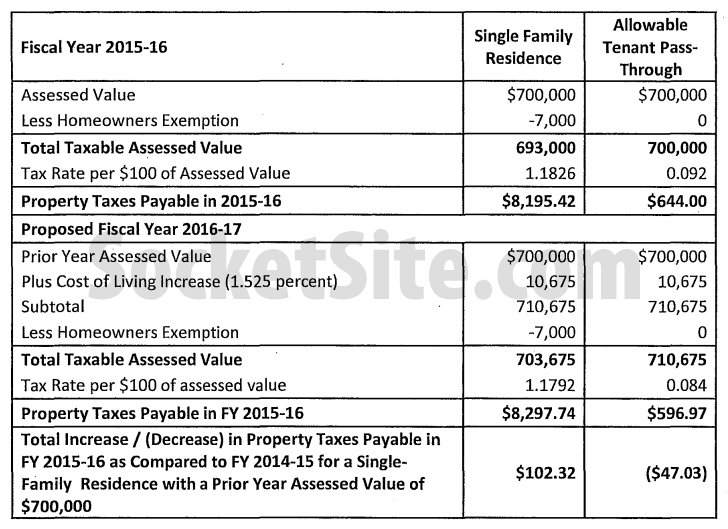

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

What Is The Tax Rate In Sunnyvale California How Much Would I Get Per Month After Taxes If My Salary Is 85000 Quora

Us Sales Tax On Orders Brightpearl Help Center

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Sales Tax

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How To Calculate Cannabis Taxes At Your Dispensary

Data Shows Steep Drop In Sf Sales Tax Revenue Possible Decline In Population The San Francisco Examiner

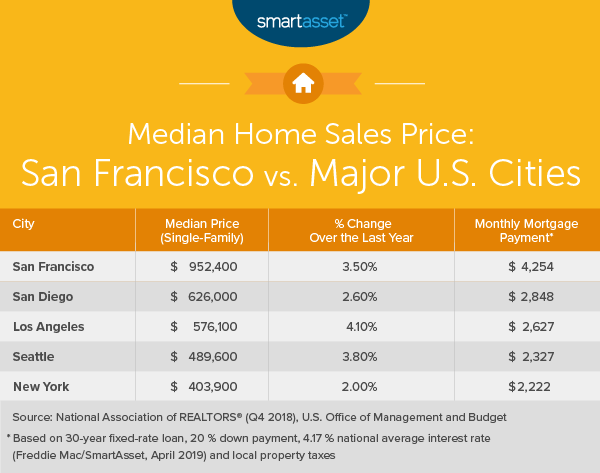

What Is The True Cost Of Living In San Francisco Smartasset

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

How Do Property Taxes Work Ruth Krishnan Top Sf Realtor

Sales Tax Collections City Performance Scorecards

Why Households Need 300 000 To Live A Middle Class Lifestyle

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go